What Does ROI Mean in Real Estate?

Return on Investment (ROI) is a key metric in real estate that helps investors evaluate the profitability of their investments. It measures the money or profit made on an investment as a percentage of its cost, providing a factual and concrete understanding of an investment's potential returns. ROI is crucial for comparing different real estate investment opportunities by allowing investors to predict their profit margin, whether through flipping homes or renting properties.

Why Understanding ROI is Essential for Maximizing Profits

Understanding and maximizing ROI (Return on Investment) in real estate is fundamental for investors to ensure the profitability and success of their investments. The key reasons why the concept of ROI is crucial are:

Making The Right Investment Decision: By calculating the ROI, investors can assess the profitability and efficiency of different real estate investments, allowing them to choose the best options based on their financial goals and risk tolerance.

Performance Measurement: ROI serves as a key performance indicator of the financial performance of investments. It measures the gain or loss generated on an investment relative to the amount of money invested.

Strategy and Planning: Knowledge of ROI helps investors forecast income and estimate total costs, which is essential for long-term financial planning and success in the real estate market.

ROI Benchmark: Having a benchmark (a double-digit ROI percentage) helps investors set targets and evaluate the attractiveness of potential investments. This benchmark can guide investors in assessing whether an investment meets their expectations for profitability.

Comparison of Investments: ROI enables investors to compare the profitability of different real estate investments, which is crucial for portfolio diversification and optimizing investment returns by selecting the most profitable properties.

Risk Assessment: By analyzing ROI, investors can assess the potential risks and rewards, helping them to make investments that align with their risk tolerance levels.

Calculating ROI on a Property: The Formula and Key Components

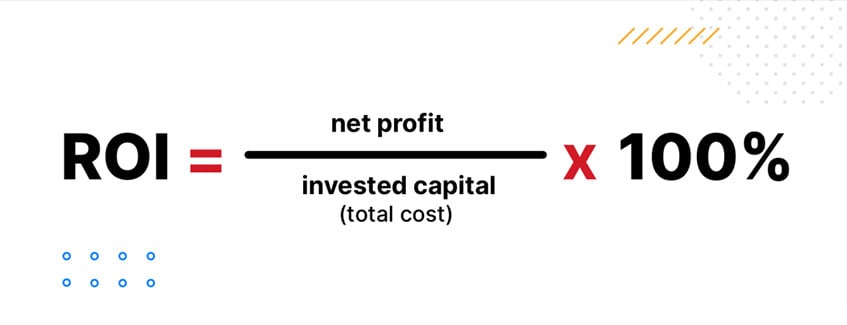

Calculating the Return on Investment (ROI) on a property is essential for real estate investors to evaluate the profitability of their investments. The basic formula to calculate ROI in real estate is:

ROI = (Total Investment Cost/Net Profit) × 100

For instance, if you purchase and improve a property for $150,000 and sell it later for $180,000, the ROI would be 20%.

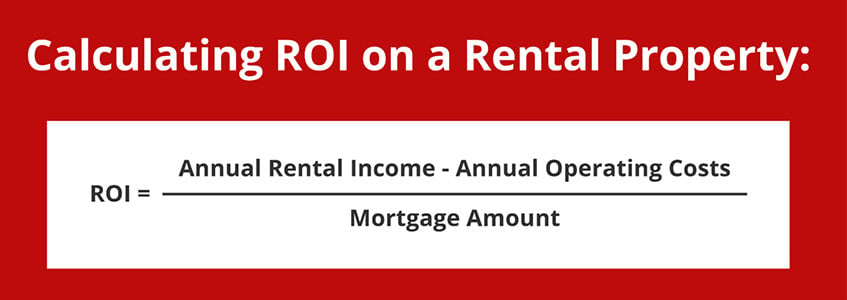

Rental Properties

For rental properties, the ROI is not only the capital appreciation but also the cash flow generated from rental income. The ROI here is derived from the net annual rental income divided by the property's purchase price. Additional expenses like property taxes, insurance, and management costs are subtracted from the gross rental income to get the net income, which is then used to calculate ROI. For a property bought for $150,000 with an annual net rental income of $10,000 after expenses, the ROI would be 6.6%.

Financed Transactions

For financed real estate transactions, ROI is calculated using the out-of-pocket method, which focuses on comparing the equity gained in the property to the market value, accounting for the leverage used in financing. For example, if you invest $180,000 out-of-pocket on a $500,000 property (including down payment and renovations) and the property's value rises to $600,000, your equity is $420,000. The ROI is calculated by dividing this equity ($420,000) by the market value ($600,000), resulting in a 70% ROI.

Cash Transaction

For investors paying in cash, the ROI is calculated by taking the annual return (income minus expenses) and dividing it by the total cash paid for the property. A property bought and improved for $150,000, generating $18,000 in annual rental income and $5,000 in expenses, would yield an ROI of 8.7%.

Key Components of ROI Calculation for Real Estate

Resales and Cash Sales: In simple resales, like flipping a property, the calculation considers the net profit from the sale and the total investment cost. For instance, if a property is bought and renovated for a total cost and then sold at a higher price, the ROI can be calculated using the difference between the sale price and the total investment as the gain.

Cash-on-Cash Return: This metric is handy for financed properties, expressing the ratio of annual cash flow to the actual cash invested upfront. It gives an insight into the yield from the property based on the cash invested, not including the benefit from financing.

Net Operating Income (NOI): NOI is critical for comparing different properties, representing the property's income after subtracting vacancy losses and operating expenses but before mortgage payments.

Capitalization Rate (Cap Rate): The cap rate estimates the return on an investment property without considering mortgage financing. It's calculated by dividing the NOI by the purchase price of the property.

Appreciation: Appreciation is the increase in the property's value over time. It's an additional benefit on top of cash flow for long-term investors but can vary greatly depending on market conditions and property location.

Internal Rate of Return (IRR): IRR measures the profitability of potential investments by calculating the rate of return that makes the net present value of all cash flows (both positive and negative) from a particular investment equal to zero.

Factors that Can Impact Return on Investment

Calculating the return on investment (ROI) for a property depends on several factors that can impact the outcome:

Location

The location of the property is crucial in determining its ROI. Properties in well-developed areas tend to have a higher ROI. Neighborhood quality directly affects property values, rental income potential, and the ease of finding tenants.

Property Condition and Maintenance

Well-maintained properties are more likely to appreciate and bring fewer costs over time. On the other hand, properties that require extensive repairs may not be worth the investment due to the high costs involved.

Rental Income and Expenses

Setting competitive rental rates and managing operating expenses efficiently can increase ROI. High operating expenses can minimize net income, affecting the overall return.

Market Conditions

Changes in the real estate market can impact rental rates and property values. Market trends can influence the demand for rental properties and the potential for property appreciation.

Common ROI Mistakes to Avoid

When entering real estate investment, avoiding common mistakes is crucial for protecting your investment and ensuring a profitable return:

Overestimating Future Profits: Basing your ROI calculations on optimistic estimations rather than solid, actual numbers can lead to misleading results.

Not Accounting All Expenses: Failing to include costs such as vacancy rates, repairs, property management fees, and other expenses can artificially inflate your expected ROI, leading to misguided investment decisions.

Ignoring Real Estate Market Research: Conducting thorough market research, including analyzing similar real estate units, is crucial for determining a property's fair market value and ensuring you don't overpay.

Underestimating the Importance of Professional Help: Real estate investing is not a solo venture. Working with a licensed real estate agent is critical for successfully navigating the complexities of real estate investments.

Strategies to Maximize Return on Investment

To maximize your ROI in real estate, it's essential to be strategic and well-informed. The most common investment strategies are:

Choose Well-Maintained Properties: Units that require minimal investment for updates and repairs can significantly reduce your initial expenses and speed up the process of getting the property to market, whether for rent or sale.

Analyze Rental Income Potential: Research the rental rates in your target area to ensure they align with your investment goals.

Focus on Location: Investing in desirable areas with essential amenities and well-established transportation can lead to higher demand and appreciation.

Diversification: Don’t limit your investments to one type of property or location. Diversifying your portfolio can spread risk and increase potential returns from different markets.

The "Buy and Hold" Strategy: This long-term investment approach involves purchasing properties to benefit from both rental income and appreciation over time. It's considered less risky compared to short-term speculative strategies.

Don’t Miss Emerging Areas: Emerging or "up-and-coming" areas often present opportunities for significant appreciation as they gain popularity and undergo development.

The Best Investment Opportunities in Turkey with TERRA Real Estate

Considering an investment in Turkey? TERRA Real Estate is your prime choice in this thriving market, offering a vast portfolio of properties that promise maximum returns. Our selection includes investment properties in Turkey that are perfect for every investor - residential units with potential for rental income, commercial spaces in bustling districts, or plots of land with development prospects. With TERRA Real Estate, you're choosing a partner who understands the Turkish market and is dedicated to helping you to make an informed and profitable purchase.